About the report

Industry reports have been compiled since the early 20th century by organizations, research firms, and trade associations of various industries, with the aim of collecting reliable data and providing data-driven approaches as a key pillar of informed business decision-making.

The function of industry reports has evolved over time; reports produced by leading management consulting firms such as McKinsey, Boston Consulting Group, and Bain serve as the industry’s go-to source for accurate data and operational experience, accurately reflecting the pulse of the industry.

Collection of reports IndustrialistThe industry-specific data chapter is one of the main centers for publishing industry-specific data. The first series of these reports provides an overview of seven key industries in Iran and includes four main sections: (1) An overview of Iran’s macroeconomics, (2) General industry statistics and trends, (3) Export statistics, and (4) Top players.

It is worth noting Full text of the report It is available for study by those interested.

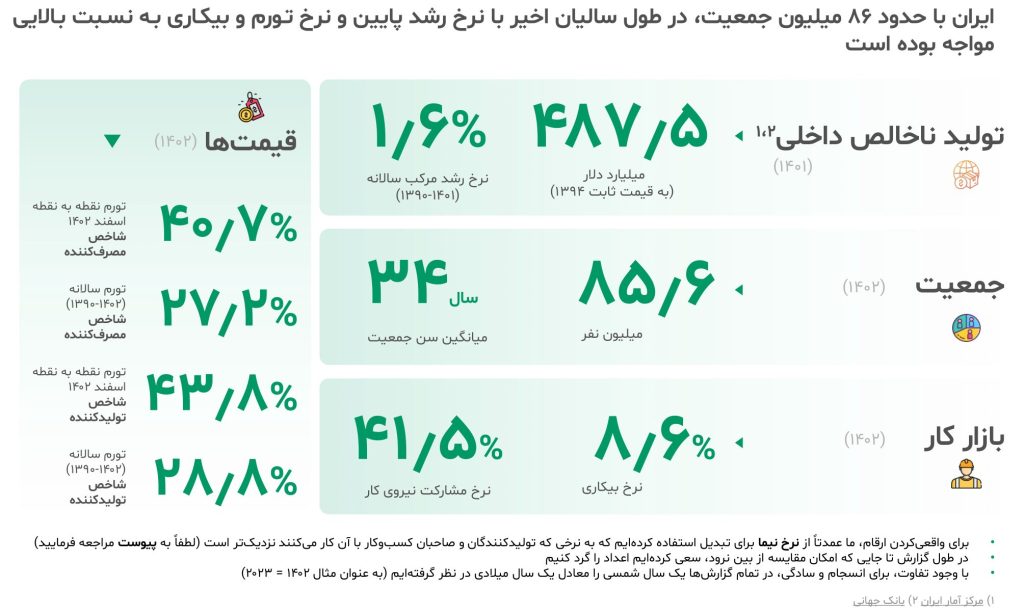

A look at Iran’s macroeconomics

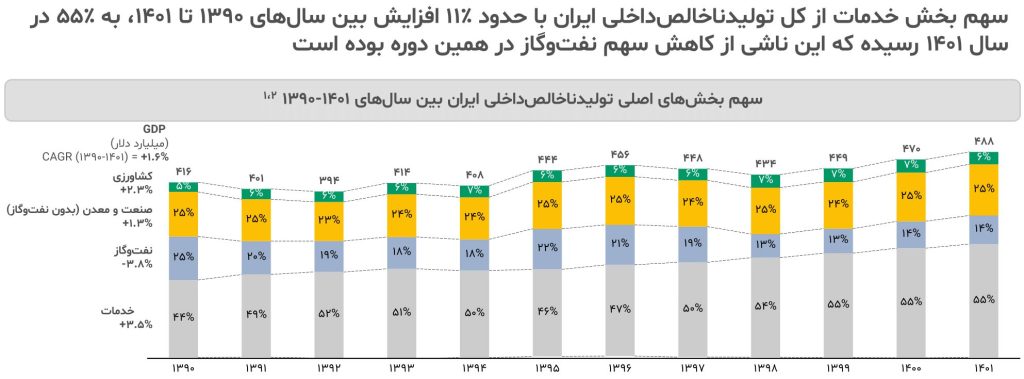

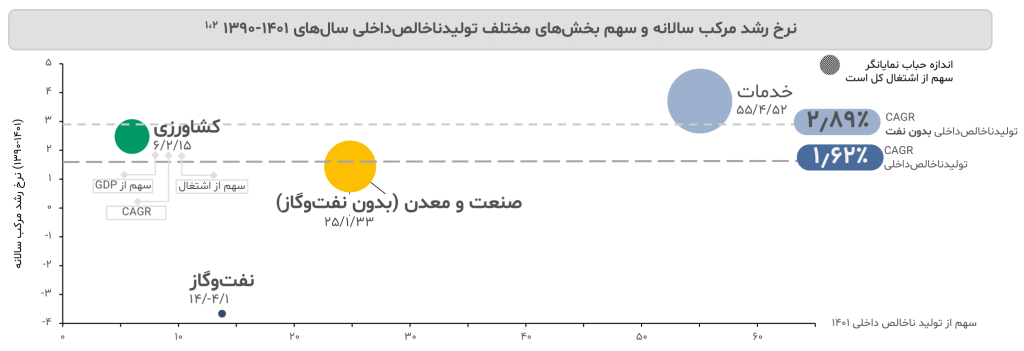

The share of agriculture and industry (excluding oil and gas) in GDP remained stable at around 6% and 25%, respectively, during 2011-2012, and during the same period, Iran’s services sector grew at a CAGR of 3.5%, while oil and gas declined at a CAGR of 3.8%, reducing the share of services to half of GDP. After 2020, Iran’s economy grew slightly, with the main burden (62%) being growth in the services sector.

Among the main sectors of GDP, between 2011 and 2022, the highest compound annual growth rates were in services (4%), agriculture (2%), industry and mining (1%), and oil and gas declined at a rate of -4%.

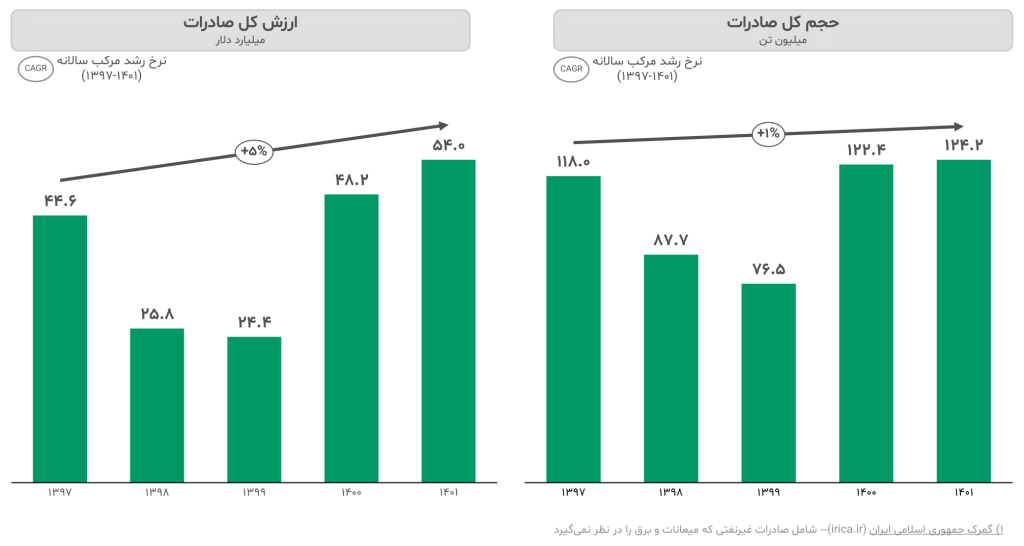

Between 2018 and 2022, the total volume of Iran’s non-oil exports increased at a compound annual growth rate of 1%, but at the same time, the total value of exports grew at a rate of 5%.

General agricultural statistics and trends

In 1401, the agricultural sector accounted for 15% of total employment and 13% of Iran’s GDP.

This report examines agriculture in three sections:

1. Herbal products

2. Livestock, poultry and aquatic animals

3. Wood

The plant products group includes all growing products, which are classified into three sections: field, garden, and greenhouse products.

Herbal products

Between 2010 and 2012, the volume of Iranian agricultural production grew at a compound annual growth rate of 3% and reached 111 million tons, 78% of which was related to crops.

Almost half of the agricultural land is under rainfed cultivation (48% of the area), but 93% of total agricultural production belongs to irrigated agriculture, and the average irrigated agricultural production per hectare is 12 times higher than that of rainfed agriculture.

Fodder corn, with 18 million tons, has the largest volume of production among irrigated crops; the largest volume of production in rainfed cultivation is wheat with 4 million tons. Iran’s “water stress” and lack of water reserves are the main obstacles to the expansion of irrigated agriculture in the country. According to calculations and estimates up to 1400, Iran’s water resources have decreased significantly by 48% in 25 years.

Livestock, poultry and aquatic animals

The second group of agricultural products belongs to livestock, poultry, and aquatic animals, and the origin of these protein products can be divided into four categories: 1- Chicken and poultry, 2- Cows, calves, and buffaloes, 3- Sheep and goats, and 4- Fish and fisheries. Among the top 5 protein products, non-meat products have a numerical advantage over animal protein products (milk 11 million tons).

It appears that Iran’s poultry industry, with a production of 2.6 million tons in 2022, is producing at half its capacity.

Wood

There is a gap of 10 million cubic meters annually between domestic wood production and demand.

According to official reports, Iranians’ per capita forest cover (0.2) is a quarter of the global per capita.

Agricultural exports

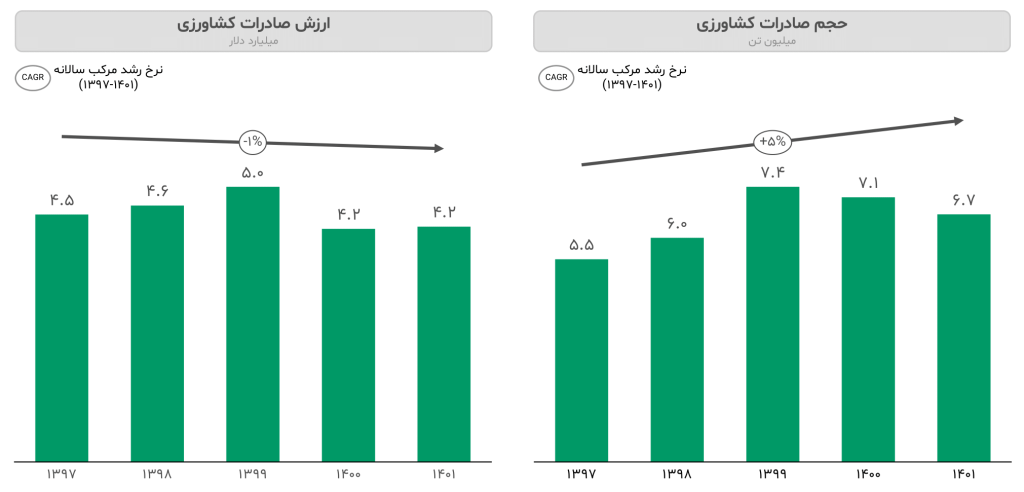

During the period 2018-2022, the volume of Iran’s agricultural exports grew at a compound annual growth rate of 5%, while during the same period, the value of Iran’s agricultural exports decreased at a rate of -1%, indicating cheap sales or the sale of cheap goods.

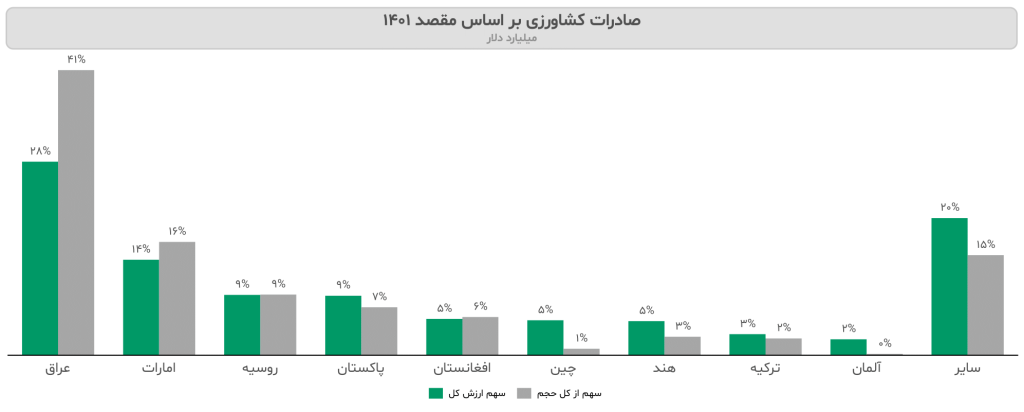

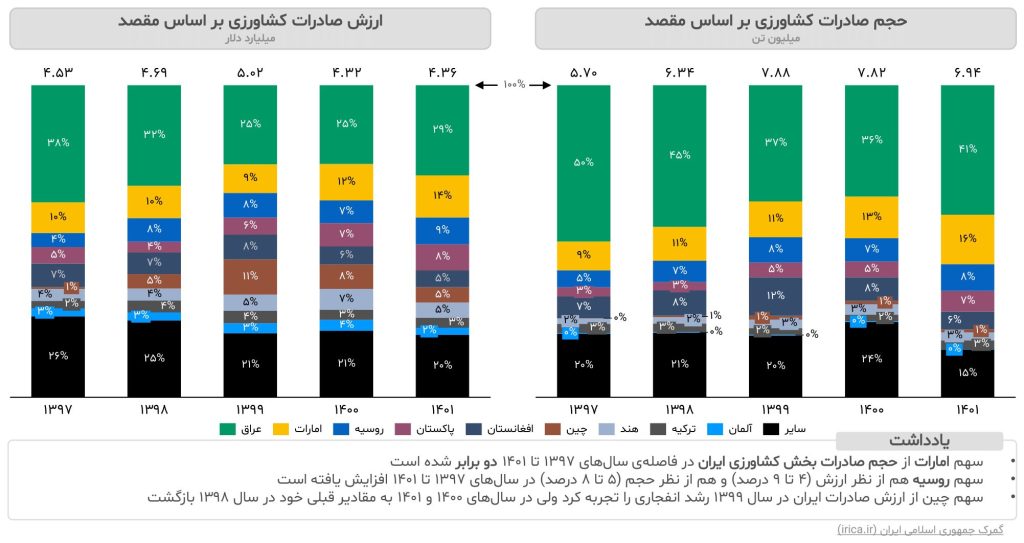

Neighboring countries are the main destination for Iranian exports in the agricultural sector, accounting for more than 50% of the value and 80% of the volume of agricultural exports.

Iraq accounts for the largest share of the value and volume of Iranian agricultural exports.

Iraq’s 28% volume share and 41% value share of agricultural exports reflect the relatively lower price per unit of agricultural exports in 1401 for this country.

Iraq’s share of Iran’s agricultural exports decreased by about 10% between 2018 and 2022, which was due to a doubling of volume for the UAE and a doubling of value for Russia during the same period.

Top agricultural players

The Industrial Management Institute (IMI) began ranking Iran’s top companies in 1998, and its latest edition was published in January 2023, covering the performance of 2021.

The main purpose of compiling the IMI-500 ranking is to determine and rank the contribution of companies to the national economy, in order to promote transparency and competition in the business environment and generally improve the position of Iranian enterprises. This comparison and ranking is based on financial information published in the companies’ financial statements.

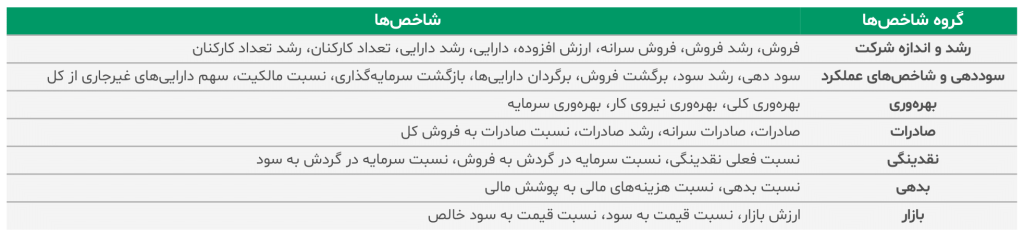

The economic effectiveness of a company’s activities at the national level is directly related to its sales volume. The Institute of Industrial Management ranks companies by considering seven main indicator categories, each of which includes specific and precise indicators:

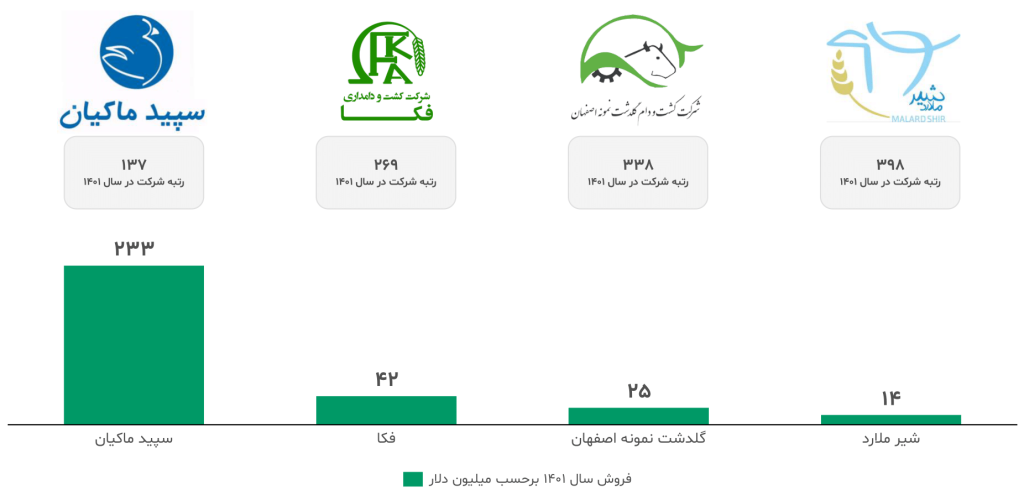

The top four companies active in the agricultural sector among the top 500 companies (IMI-500) are Sepid Makian (ranked 137), Feka (ranked 269), Goldasht Nomne Isfahan (ranked 338), and Shir Mallard (ranked 398). Although 13% of Iran’s GDP is provided by the agricultural sector, we see that agricultural companies do not rank highly in the sales sector, indicating the lack of large companies in this industry.

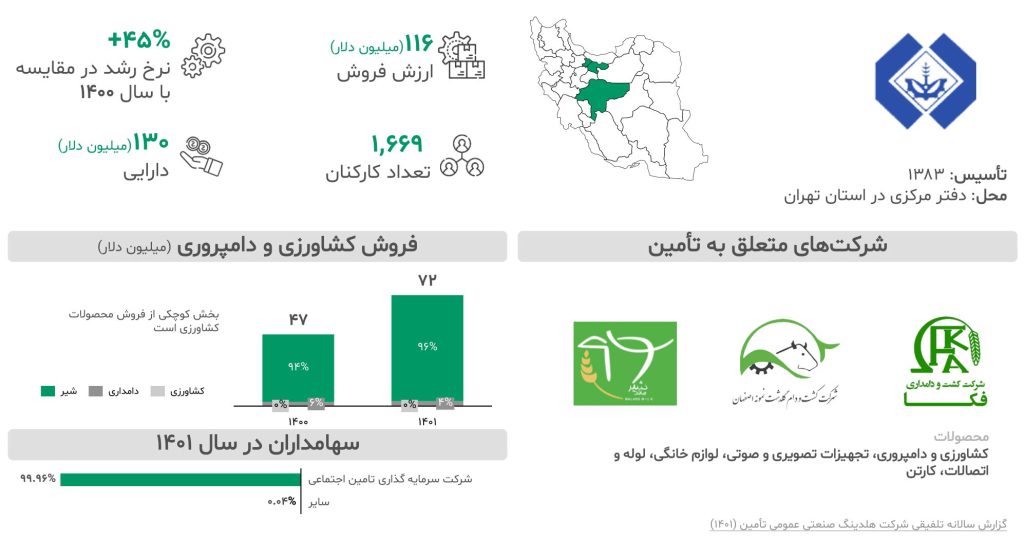

General Industrial Supply Holding: Major shareholder of three agricultural industry players