About the CEO Report

In the CEO reports, Ilia Management Consulting Company aims to provide a comprehensive analysis of organizational performance, economic and business conditions, and forecasts for the coming year by examining the concerns, approaches, lifestyles, and work styles of Iranian CEOs.

The idea behind the title “Rheotaxis” comes from the concept of rheotaxis. Rheotaxis is a form of locomotion among aquatic animals that swim against the current. This behavior helps them avoid dangerous areas, maintain their position, or swim upstream instead of being pushed downstream by the current; our businesses must also move against the flow of the macro economy, actively driving market growth and expansion to remain sustainable.

The main differences between this issue, which was published in 1403, and the previous issue include an increase in the number of non-governmental CEOs participating in the questionnaire, an increase in the dispersion of industries in the sample, and the addition of sections such as measuring the most important programs and areas of focus, development programs, and prioritizing stakeholders in CEO decisions.

It is worth noting Full text of the report It includes more details on each of the items mentioned, as well as items such as sample information, research methodology, etc., for those interested in studying. Below, we will review some of the most important results of this report.

CEOs’ views and concerns

Financial performance and non-financial goals in 1402

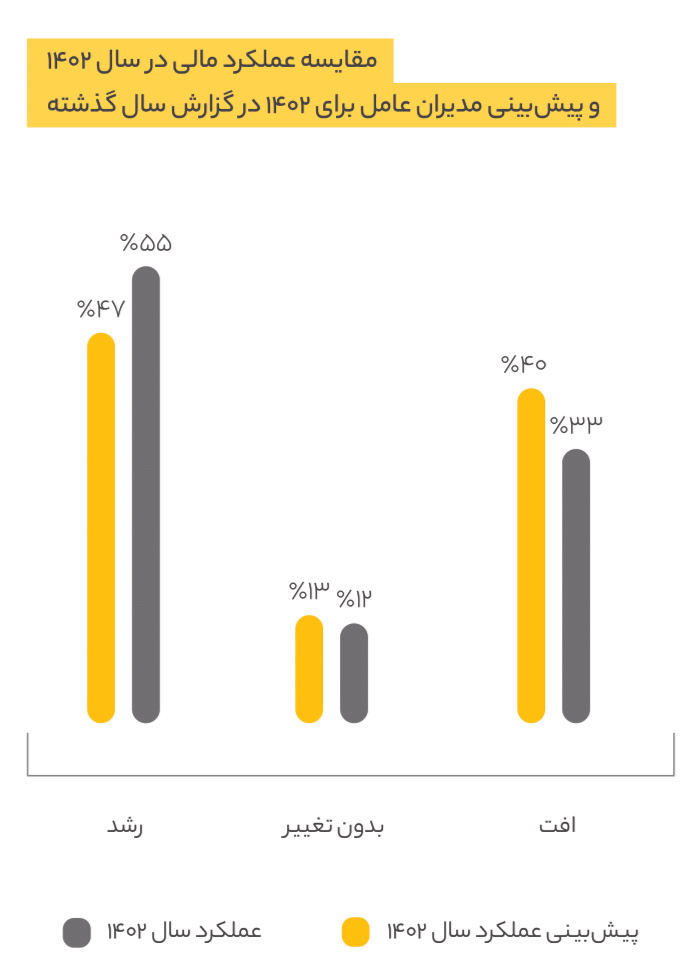

55% of CEOs have acknowledged the growth in the financial performance of the company under their management in 1402. Also, about 33% of managers have reported a (relative or significant) decline in their business this year. Another 12% have not seen any difference in their company’s financial performance.

In examining the level of achievement of non-financial goals among companies, it was found that only 28% of CEOs achieved their company’s non-financial goals, and 38% of them achieved their goals to an average extent. In general, CEOs performed better in 1402 than they predicted and expected for this year.

CEOs’ predictions about the economic situation and their company

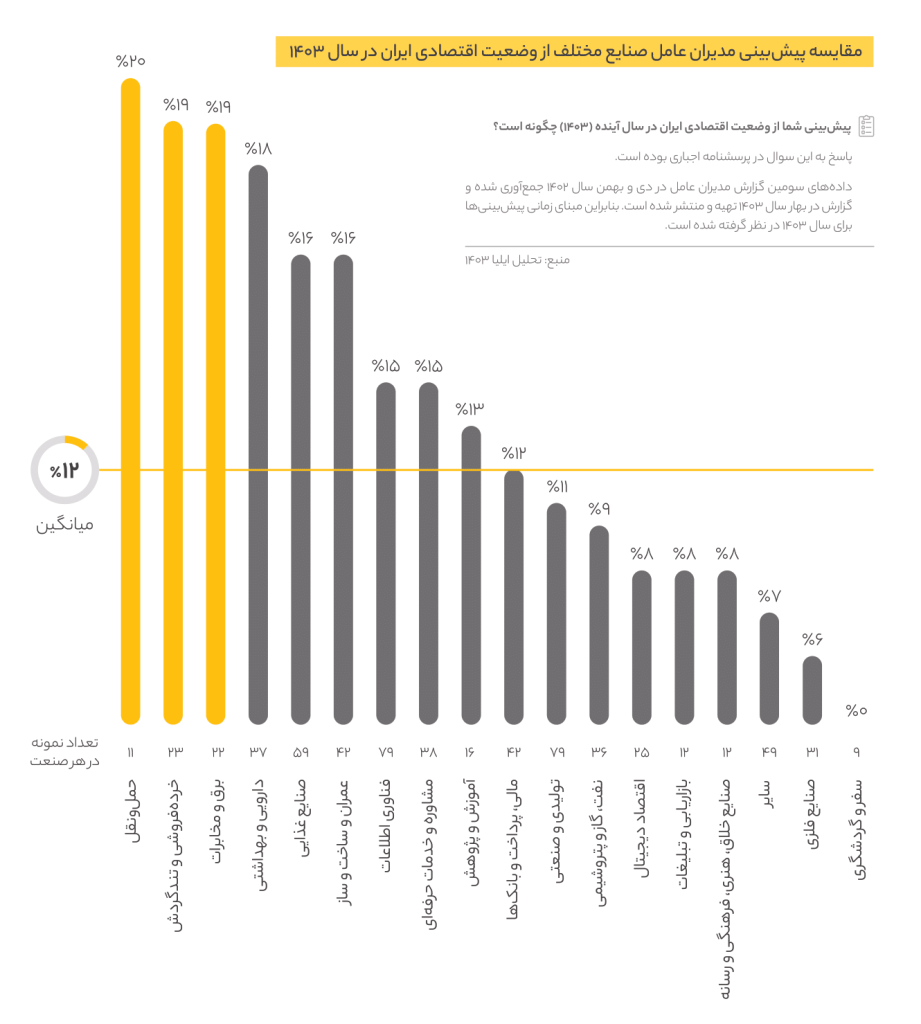

32% of CEOs participating in the current survey predicted a major recession for 1403. 44% of managers believe that the Iranian economy will witness a relative recession in 1403, and only 12% hope for economic prosperity next year. The level of hope for prosperity last year was 5%.

Among the industries surveyed in the survey, CEOs of transportation companies, companies active in the retail and fast-moving industries, and electricity and telecommunications are in the first to third place among the industries most hopeful for Iran’s economic growth in 1403. Interestingly, none of the CEOs of travel and tourism companies believe in economic prosperity in the coming year.

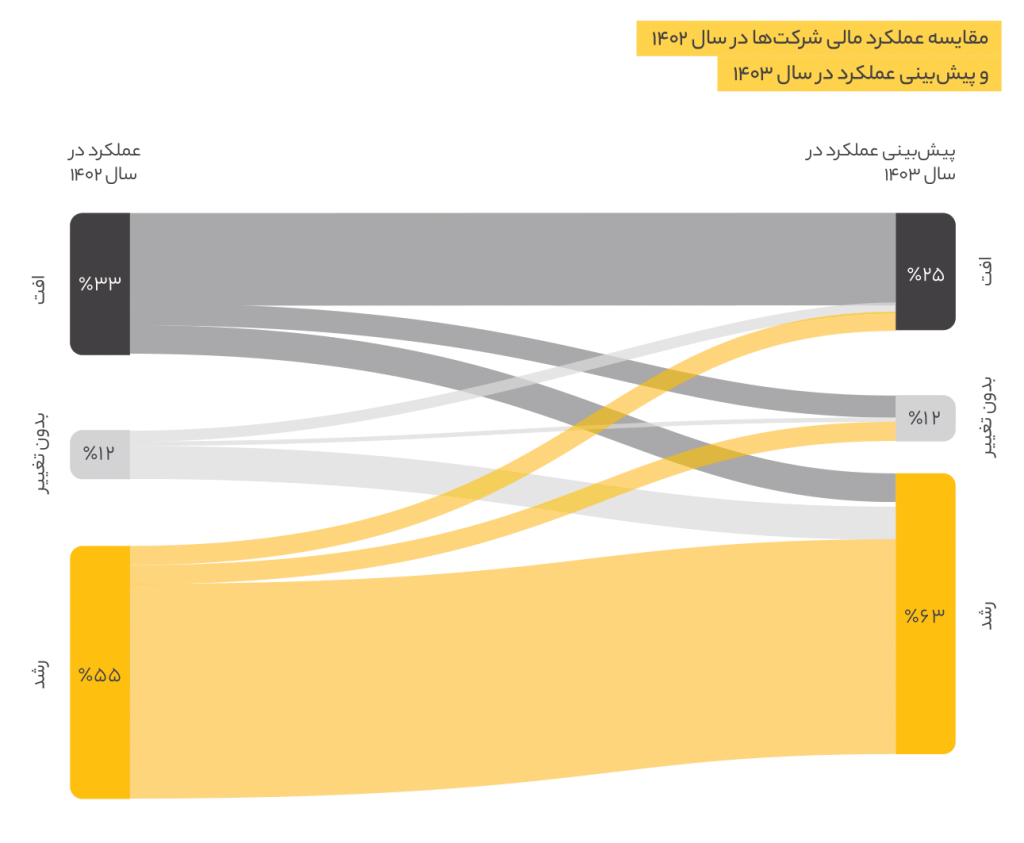

63% of CEOs have predicted and are hopeful for the company’s financial growth for 1403, while this figure was 47% for last year.

On the other hand, 25% of managers participating in the current survey predicted a relative or significant decline in their company’s performance next year, and 12% did not foresee any tangible change in their financial performance.

Nearly 9% of CEOs predict financial growth for their company in 2023, despite experiencing a decline in financial performance in 2023.

The most important concerns of CEOs and the fundamental problems of companies

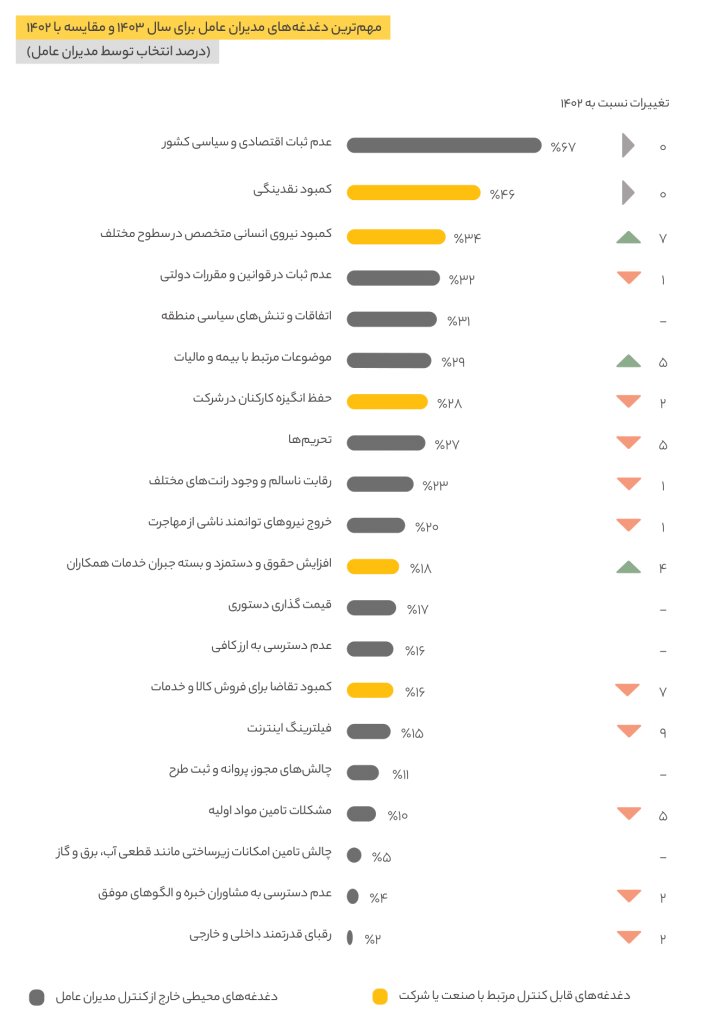

In the current survey, the top three concerns of CEOs are political and economic instability, lack of liquidity, and lack of skilled human resources at various levels. Among them, insurance and tax-related issues have gained more priority than last year, becoming the sixth most important concern of CEOs.

Among CEOs of companies with a turnover of less than 20 billion Tomans, there is a strong concern about issues related to insurance and taxes. Prescriptive pricing and lack of access to sufficient foreign exchange are among the concerns that are more prominent and have a higher priority for CEOs of companies with a turnover of more than 20 billion Tomans.

CEOs’ programs and areas of focus

Among the most important plans of CEOs for 1403 (2024), increasing sales and market development is chosen by 45% of CEOs. 35% of managers tend to focus on increasing product diversity or market development or reducing operating costs in 1403 (2024).

CEO Lifestyle and Work Program

CEO Lifestyle Program

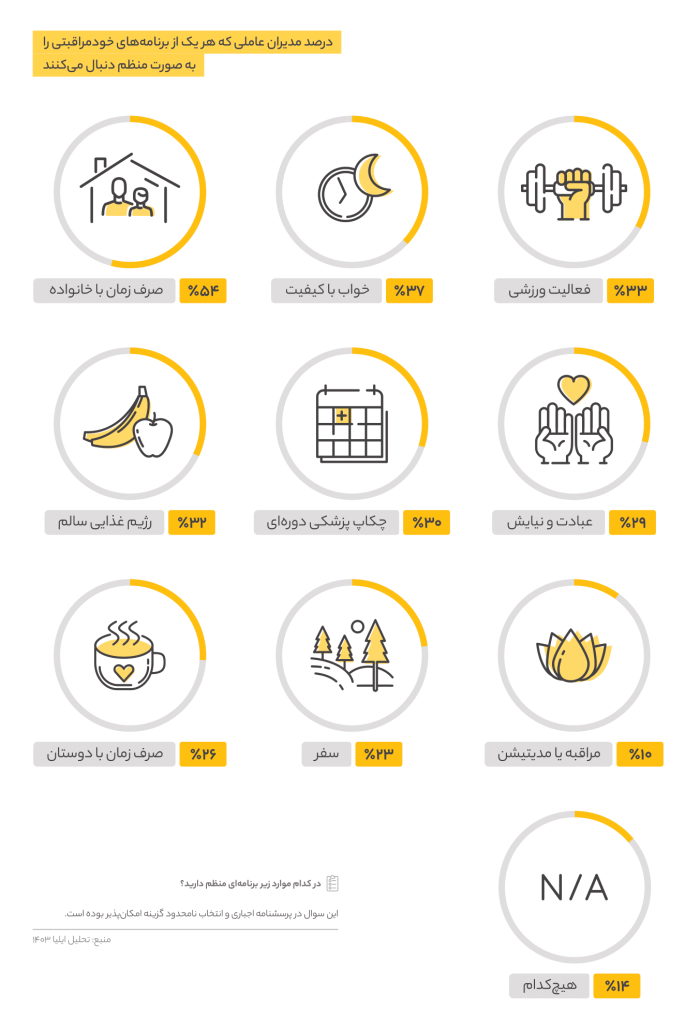

Spending regular time with family is the most common lifestyle activity among CEOs. Getting quality sleep is listed as a top self-care routine by only 37 percent of CEOs, roughly the same as last year.

CEO focus and development programs

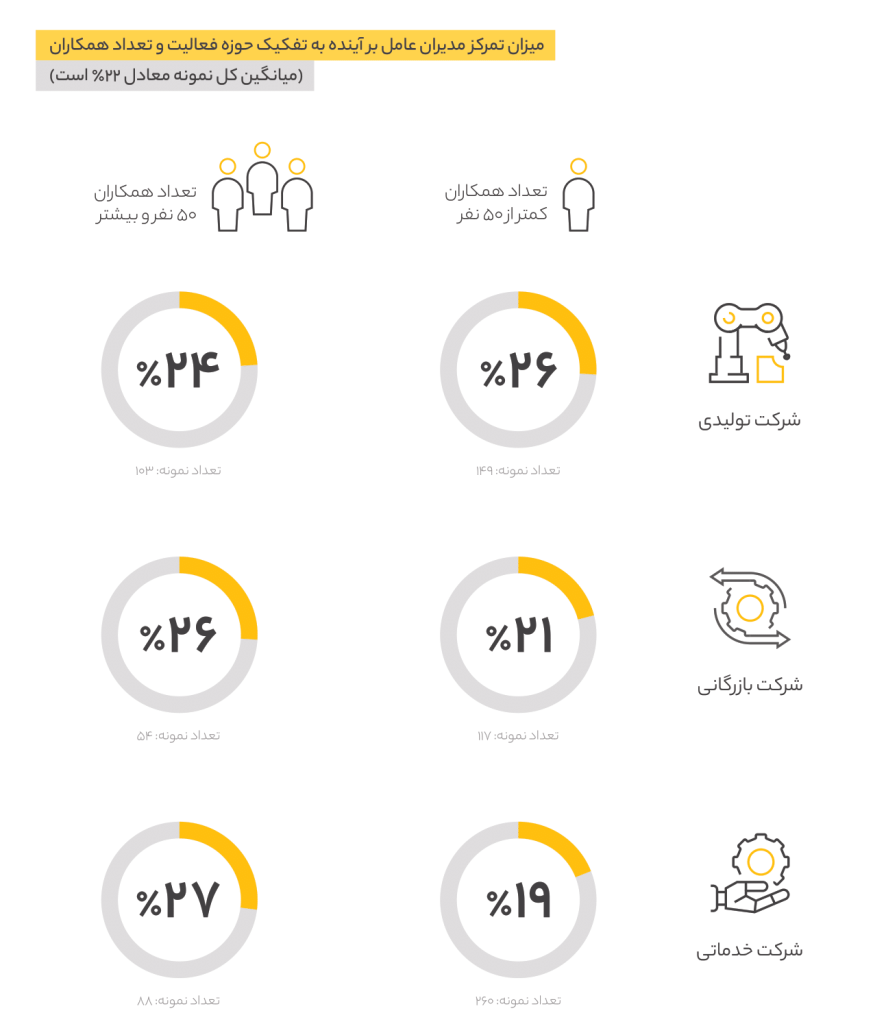

The art of CEOs is to strike a balance between focusing on current and future issues. According to the survey, the majority of CEOs (71%) focused on current and operational issues, with only 7% of CEOs dividing their time equally between current and future issues.

22% of CEOs also stated that their main focus of thought and time was on issues related to business development and growth, and in other words, the future of the company. Among the diverse areas of activity of companies, smaller service companies are less focused on their future issues than other companies.

Professional services used by CEOs

Of the various services and methods available for personal development and business growth, the most frequently used by CEOs is the services of a business consultant (43%), and 29% do not use any of the common professional services on a regular basis. The services used by managers in the next ranks include: sports and fitness services (28%), personal coaching/management trainer (22%), psychologist and psychoanalyst (20%), health and nutrition consultant (14%).

CEOs’ perspective on the issue of liquidity shortage

Investigating the problem of companies’ lack of liquidity

The problem of lack of liquidity in companies can be defined at different levels. The first level is the problem of lack of liquidity to cover operating costs, which 33% of CEOs have described as their problem of this type.

At the next level, 25% of CEOs said they are facing difficulty improving their company’s operations and productivity due to a lack of liquidity.

Finally, 44% of CEOs face liquidity problems in expanding their current business multiple times, which was also the most frequent problem.

Meanwhile, 38% of CEOs have stated that they have a problem with a lack of liquidity to implement new ideas.

However, 10 percent of CEOs said they do not have a liquidity problem in their company. The two main liquidity problems of CEOs of companies with a turnover of less than 20 billion Tomans are covering operating costs and implementing new ideas.

According to CEOs, economic recession, reduced purchasing power, and shrinking markets are the most important factors affecting the liquidity shortage.

CEOs’ solutions for dealing with liquidity problems

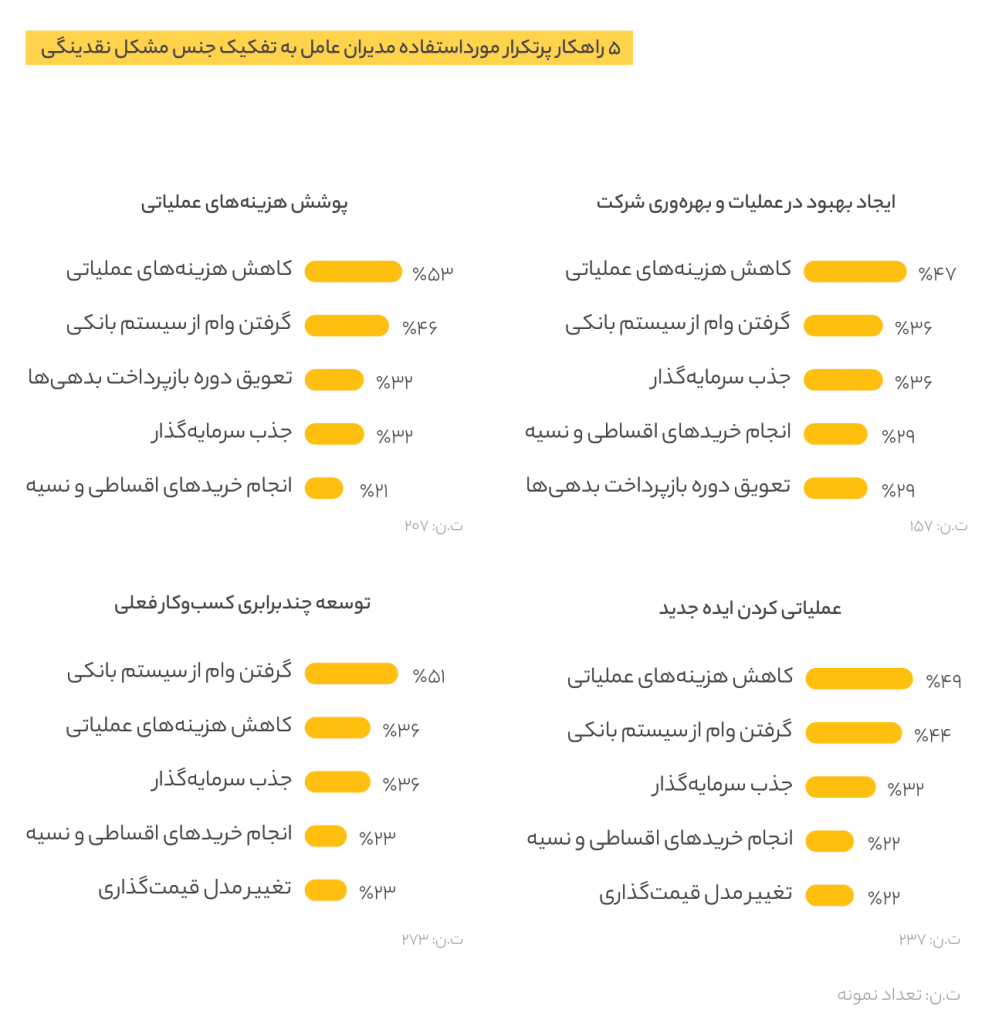

Depending on the nature of the liquidity problem and the capabilities of each company, solutions are adopted to deal with this issue. The 5 cases with the highest percentage of selection are as follows:

Reduced operating costs (44%)

Taking out a loan from the banking system (44%)

Investor attraction (32%)

Postponement of debt repayment period (23%)

Changing the pricing model for products and services or payment methods (21%)

However, 6% of CEOs said they have no solution to overcome this problem. Taking out a loan from the banking system and reducing operating costs are two solutions used by managers who are concerned about the lack of liquidity to expand their current business multiple times.

Cash flow forecasting is a method of predicting the financial status of a business by estimating the amount of cash that is expected to come in or go out over a specific period of time, and is of great importance in planning and advancing a business.

32% of CEOs said that cash flow forecasting in their company is good, while 19% said that cash flow predictability in their company is low or very low.

Business space trends

The extent to which the resources of various stakeholders are considered in the company’s macro-level decisions and strategies

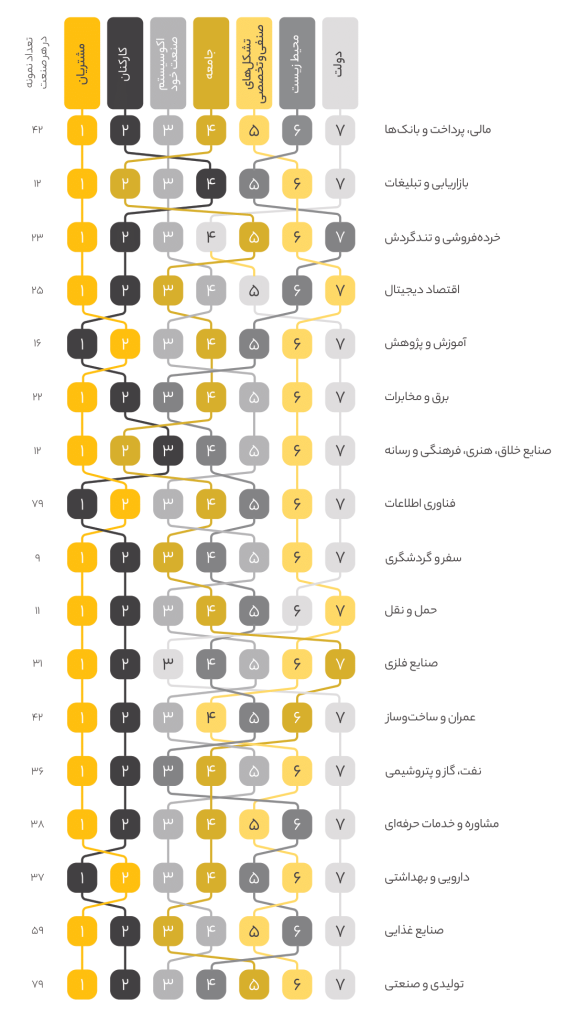

The most important stakeholders in strategic decision-making of companies are two categories: customers and employees of the company. In the next steps, attention is paid to the ecosystem of the industry itself, society, the environment, and professional and professional organizations, and the least attention of companies in decision-making is paid to the government. The most important stakeholders in strategic decision-making in the information technology, education and research, and pharmaceutical and health industries are the company’s employees, and in other industries, customers.

The most impactful actions of CEOs to improve society

By analyzing the responses related to the most effective actions of CEOs to improve the conditions of society, adherence to professional ethics and human values has been identified as the most effective action of CEOs, which can lead to smaller, healthy groups that ultimately build society.

After that, survival and maintenance of the current business, providing a quality product or service, and empowering colleagues received the highest scores. On the other hand, two percent of CEOs believe that in the current situation, no action by CEOs will have an impact on improving the conditions of society.

Digital transformation, concepts and applications and implementation status

Familiarity with the concepts and applications of disruptive digital technologies is a necessity for managers operating in today’s world. CEOs who are leaders in this field can lead their companies to future success.

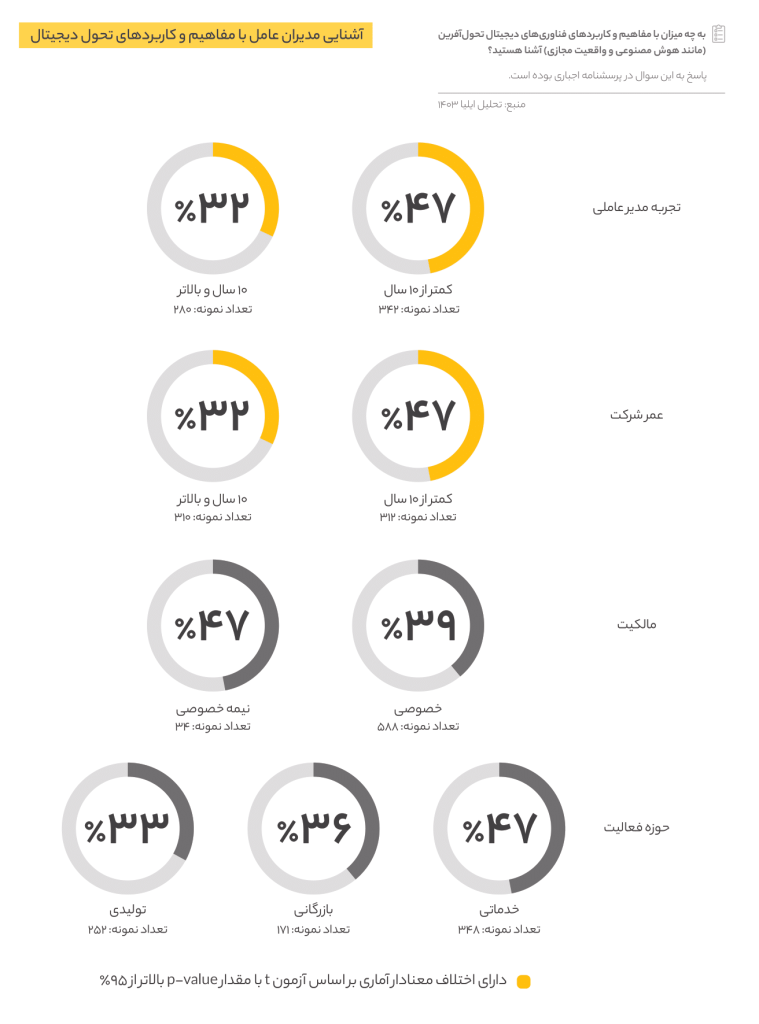

Based on the results obtained from the questionnaire analysis, 40% of managers are very familiar with the concepts and applications of transformative digital technologies.

On the other hand, 19% of CEOs have little familiarity with digital transformation concepts. This can be challenging for their companies, as digital transformation is increasingly becoming a necessity for businesses. There is a significant difference in the level of familiarity with digital transformation concepts between CEOs of companies less than 10 years old and those more than 10 years old.

Summarizing results and proposing solutions

Proposed solutions to the liquidity problem

Given the importance and priority of the issue of liquidity shortage, as well as the problems of economic instability that the CEOs have outlined in this report, what solutions can be considered and implemented?

- Investigating and applying different financing methods

- Financing from business partners: in the form of pre-sale of the product and payment to suppliers over a longer period of time

- Financing from lenders: bank facilities, debt issuance or crowdfunding methods, as well as private borrowing

- Financing through capital raising, attracting new investors, and joint ventures: Reducing risks and costs for both parties in addition to financing

- Implementing cost management systems

- Aligning costs with the organization’s strategies: Reducing costs means aligning costs with the organization’s strategy. In the first step, the organization needs to have a clear strategy for its business and know how it wants to earn income, and then align the cost structure with the strategy.

- Increasing productivity: Standardizing and automating processes and increasing organizational agility, as well as employing innovative methods such as digital technologies and artificial intelligence, or even changing the business model to implement digital transformation projects, can help reduce costs and create organizational capabilities.

Proposed solutions for the problem of attracting and retaining expert human resources

Attracting and retaining expert and high-performing colleagues is becoming increasingly difficult on the one hand, and on the other hand, it is considered a very decisive factor in the fate of companies. The proposed solutions for mechanisms and processes in this area are briefly summarized below:

- Priority of payment method over payment amount: For example, experience-based and qualification-based payments in companies reduce the motivation of capable individuals.

- Improving performance management systems: Any system that is used will lead to dissatisfaction among some people, but a system that does not work accurately at the individual, team, and company levels will lead to dissatisfaction among the best.

- Using non-financial and spiritual systems: Systems such as manager appreciation and awarding honorary badges are very effective in increasing people’s organizational commitment. In other words, an organization can have three types of promotions: vertical, horizontal, and honorary.

- Creating development and learning opportunities: An organization that can provide development opportunities such as challenging and meaningful work, holding training courses, allocating training budgets to individuals, etc. will be more successful in attracting and retaining employees.

- Creating succession plans: Succession plans can clarify the future of the company for high-performing employees and show them that the organization has a clear plan for them and that they can grow in terms of learning, impact, and income by staying with the company.

- Improving relationships between colleagues: It is recommended that companies invest in promoting culture and skills of dialogue and mutual understanding. In particular, the leadership and coaching skills of managers have a direct impact on the motivation and perceived support of individuals in the organization.

Proposed solutions to the problem of lack of demand and shrinking market

Lack of demand and shrinking market have been raised as the third issue by CEOs. On the other hand, by reviewing and examining the country’s economic indicators, recession, inflation, and exchange rate fluctuations add to the severity of this issue in the country’s business environment. In this regard, company managers need to adopt appropriate strategies to deal with lack of demand and market changes.

When the domestic market does not provide growth opportunities (countercurrent in the macroeconomic river) and even the level of demand and market size is likely to shrink, a strategy for survival and growth can be to enter the markets of other countries. Internationalization is the process of adapting and offering products and services in foreign markets as a core strategy.

Internationalization has various forms and stages, such as exporting, licensing and franchising, joint ventures and partnerships, mergers and acquisitions, and the development of subsidiaries. Depending on the type of product and service and the conditions of the destination country, one of these types can be used.

In this regard, the operational suggestion is that organizations assess their readiness and their products and services for internationalization, examine different markets, choose an international market as a starting point, choose one of the various methods of internationalization, and implement and take action. They should note that the probability of success in the first steps is not high and this requires practice and follow-up, but it can change the fate of the company.

Suggested solutions to the resource shortage problem

Increasing sales and market development and increasing the diversity of products or services are the two main plans of CEOs for 1403. However, they face a set of obstacles and limitations in implementing these plans. Some of these obstacles and problems are partially controllable by the company, such as the lack of liquidity and specialized human resources, which were among the most important issues and challenges for managers last year. There are also other obstacles, such as economic instability and tax and insurance issues, which are beyond the control of CEOs and companies and affect their development plans.

Mergers and Acquisitions (M&A) When resources are not available in the environment (countercurrent), companies need to engage in more collaborative activities to learn from each other’s experiences and share solutions and resources. To overcome these obstacles, they can develop joint products or services with partner companies in the industry or jointly target new markets. This concept falls under the category of mergers and acquisitions strategy for medium and large companies. Today’s conditions require that companies can use this strategy to develop their capabilities more quickly and reduce their costs by using economies of scale.