About the report

Industry reports have been compiled since the early 20th century by organizations, research firms, and trade associations of various industries, with the aim of collecting reliable data and providing data-driven approaches as a key pillar of informed business decision-making.

The function of industry reports has evolved over time; reports produced by leading management consulting firms such as McKinsey, Boston Consulting Group, and Bain serve as the industry’s go-to source for accurate data and operational experience, accurately reflecting the pulse of the industry.

Collection of reports IndustrialistThe industry-specific data chapter is one of the main centers for publishing industry-specific data. The first series of these reports provides an overview of seven key industries in Iran and includes four main sections: (1) An overview of Iran’s macroeconomics, (2) General industry statistics and trends, (3) Export statistics, and (4) Top players.

To download Full text of the report Click.

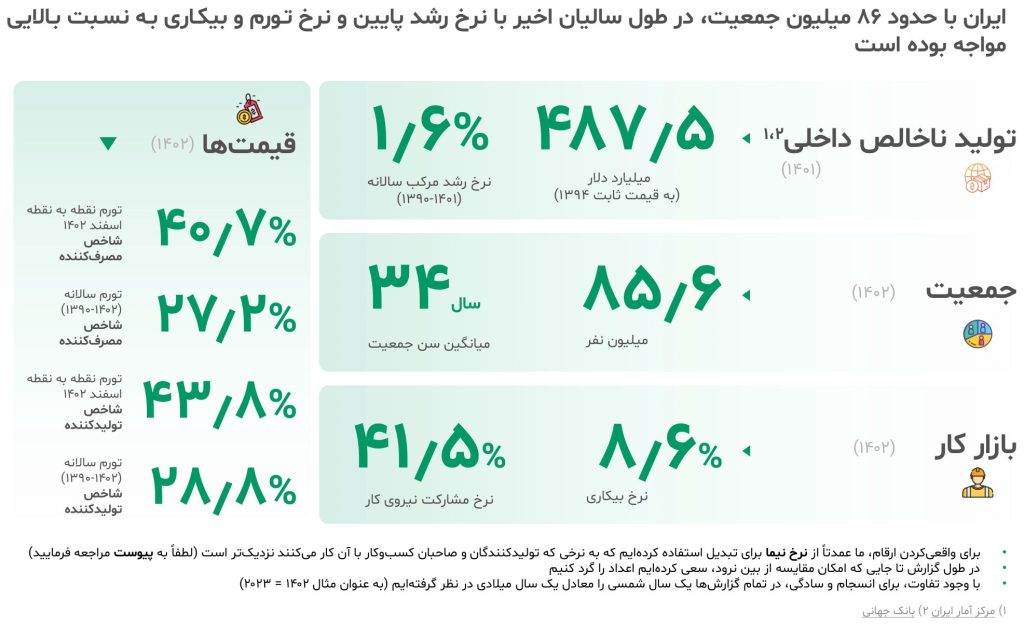

A look at Iran’s macroeconomics

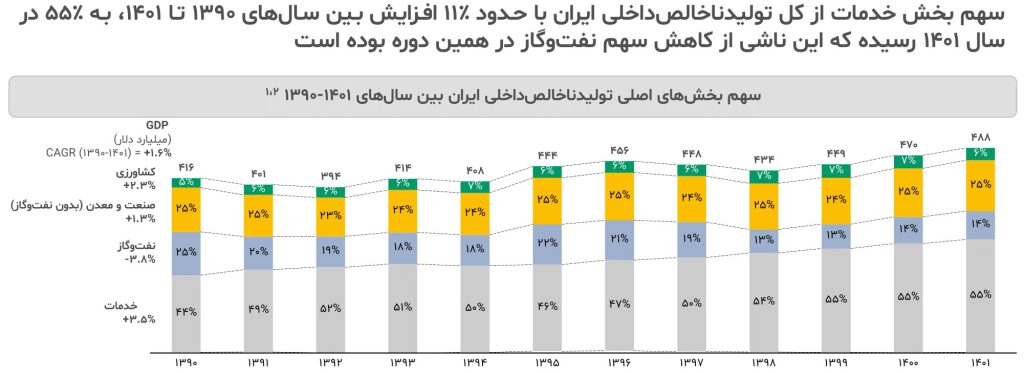

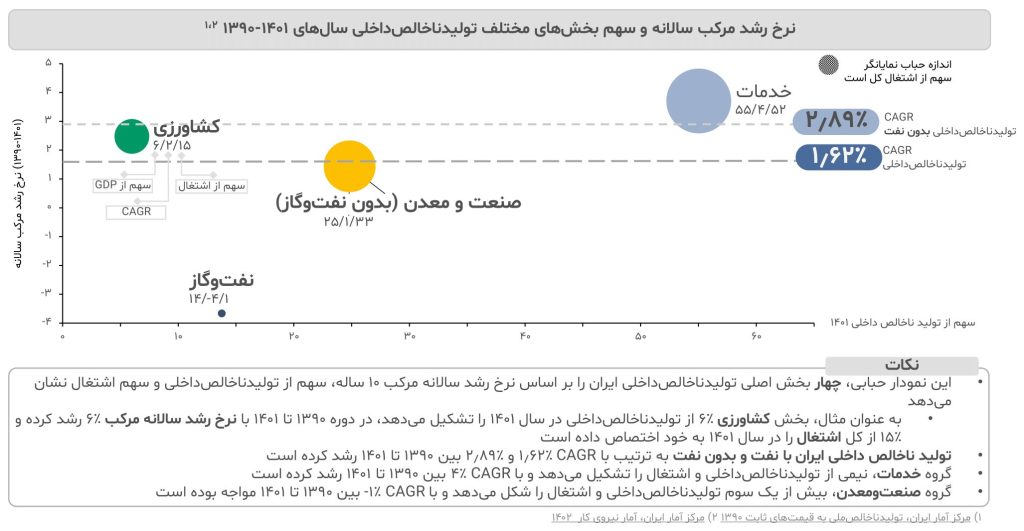

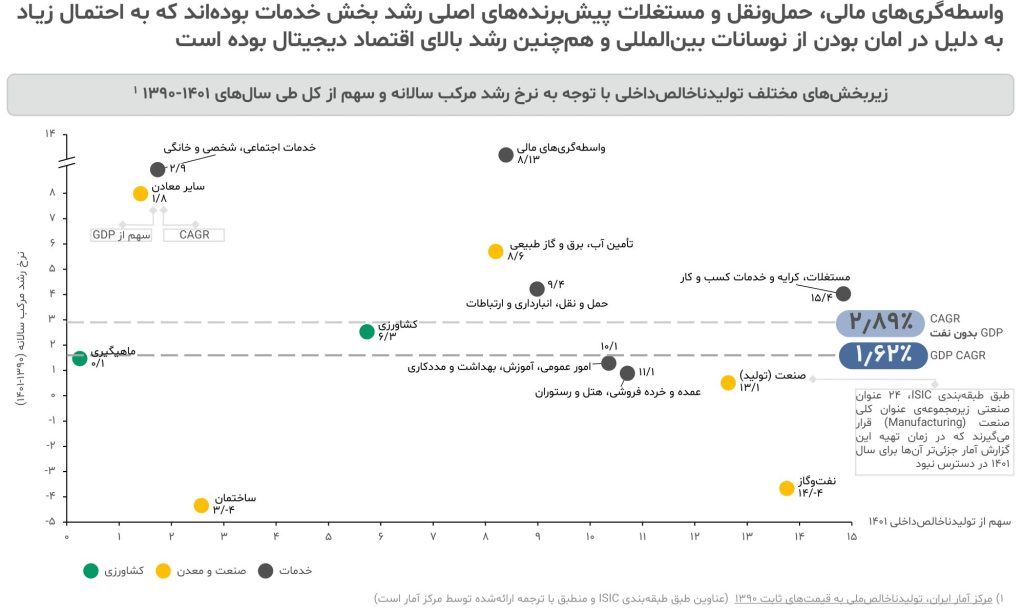

The share of agriculture and industry (excluding oil and gas) in GDP remained stable at around 6% and 25%, respectively, during 2011-2012, and during the same period, Iran’s services sector grew at a CAGR of 3.5%, while oil and gas declined at a CAGR of 3.8%, reducing the share of services to half of GDP. After 2020, Iran’s economy grew slightly, with the main burden (62%) being growth in the services sector.

Among the main sectors of GDP, between 2011 and 2022, the highest compound annual growth rates were in services (4%), agriculture (2%), industry and mining (1%), and oil and gas declined at a rate of -4%.

Financial intermediation, transportation, and real estate have been the main drivers of service sector growth, likely due to their immunity from international volatility as well as the high growth of the digital economy.

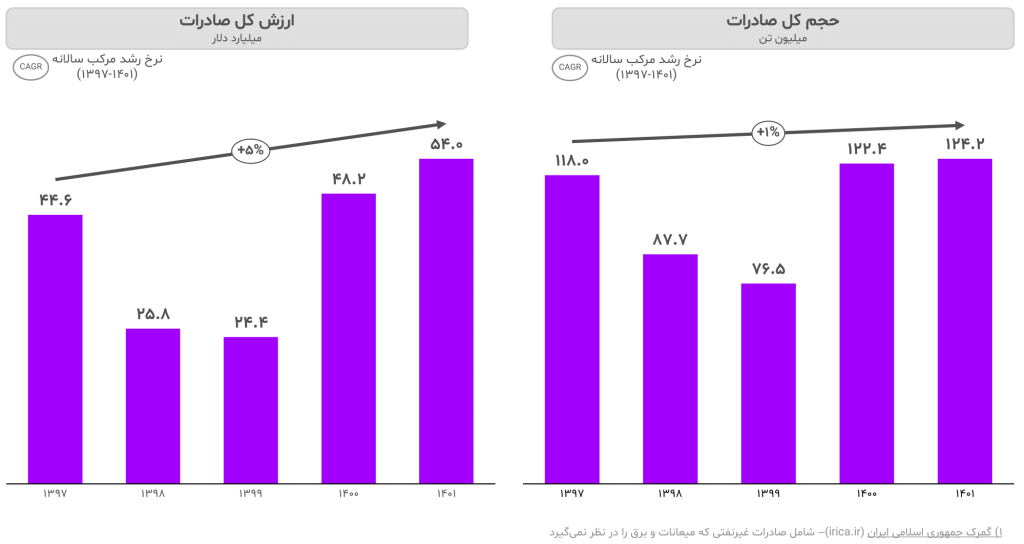

Between 2018 and 2022, the total volume of Iran’s non-oil exports increased at a compound annual growth rate of 1%, but at the same time, the total value of exports grew at a rate of 5%.

General petrochemical statistics and trends

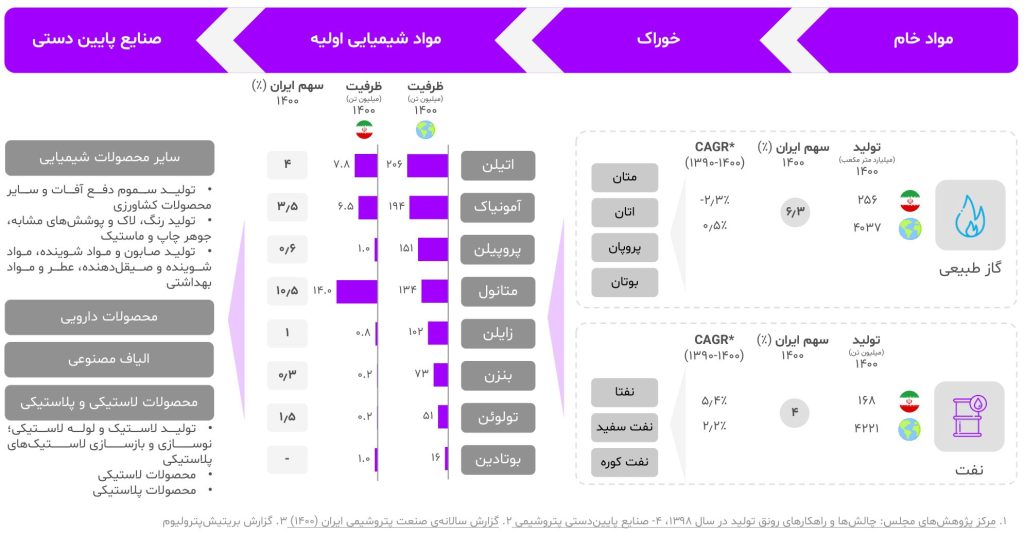

Iran’s methanol production capacity in 1400 was equivalent to 10.5% of global production capacity, followed by ethylene (4%) and ammonia (3.5%), respectively.

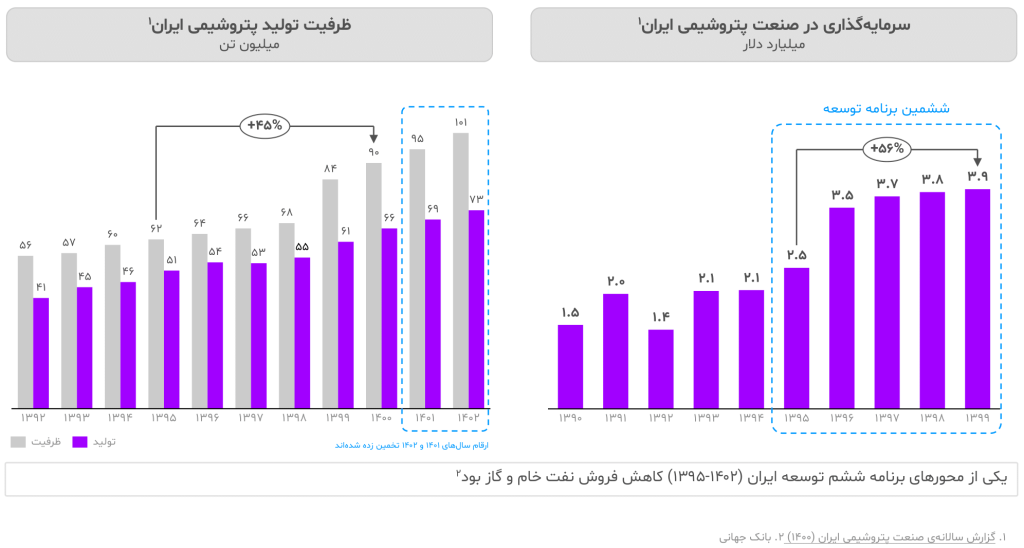

Between 2016 and 2022, investment in the petrochemical industry increased by 56%, so production capacity is expected to increase in the coming years.

In this report, petrochemicals are examined in five main groups, including the following:

- Polymer materials

- Organic chemicals

- Aromatics

- Hydrocarbons

- Fertilizers, pesticides and related materials

Among the various products in these groups, eight selected products have been reviewed briefly;

- Ethylene, propylene, methanol and butadiene from the group of organic chemicals

- Benzene, toluene, and xylene, from the aromatics group

- and ammonia from the group of fertilizers, pesticides and related substances

The information available in the report regarding the 8 products includes the following:

- Introduction

- Capacity and production in 1400

- Information and tips related to production or export

- Downstream industries

- The best Iranian actors

- The best actors in the world

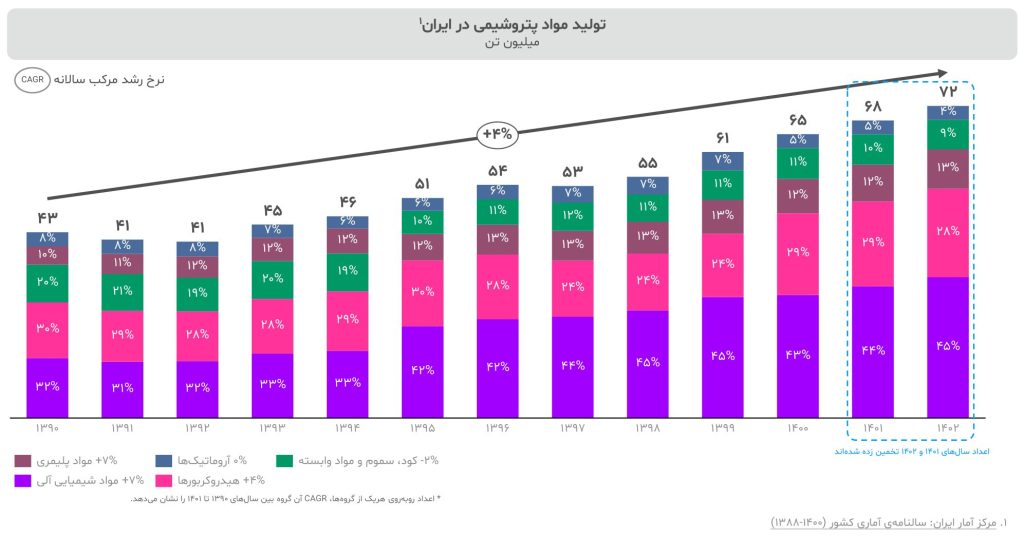

Petrochemical production grew at a compound annual growth rate of 4% from 2011 to 2021, with organic chemical products and polymeric materials experiencing the highest production growth among products.

Petrochemical exports

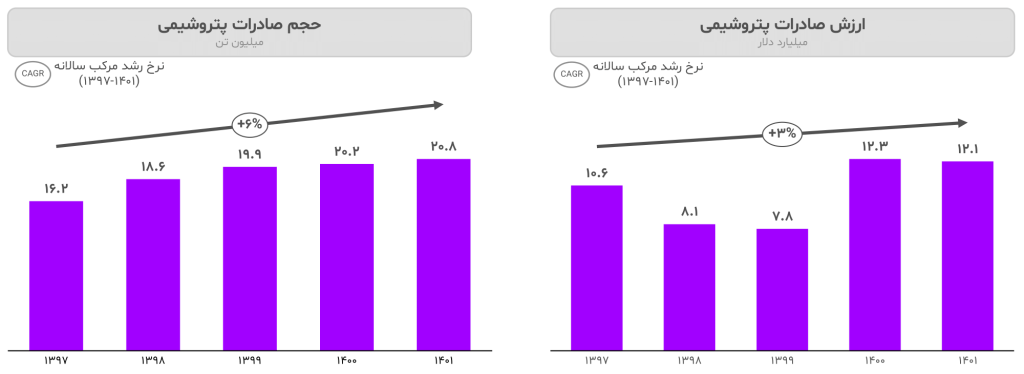

The volume and value of Iran’s petrochemicals experienced an average compound annual growth rate of 6% and 3% between 2018 and 2022, indicating a decrease in the unit value of Iran’s petrochemical exports.

The obstacles to exports caused by sanctions, along with other international issues, have caused Iranian exports to face price declines over the years.

In such circumstances, reducing the price of exported products has been more cost-effective in order to prevent a drop in production, which would result in higher costs for the producer.

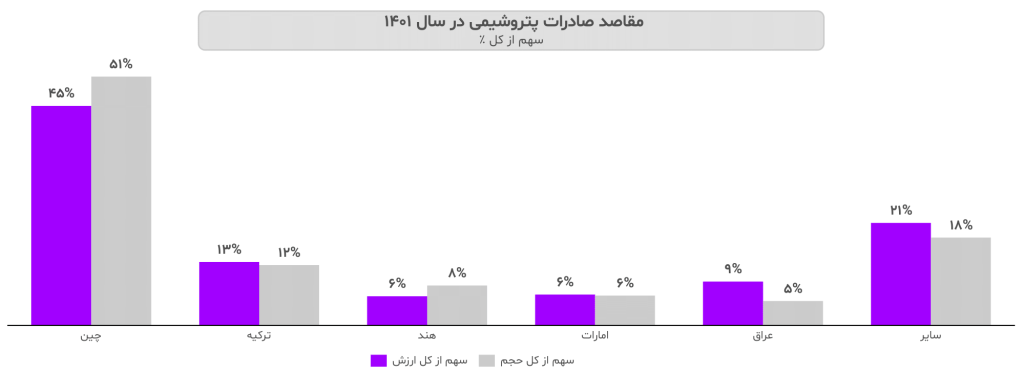

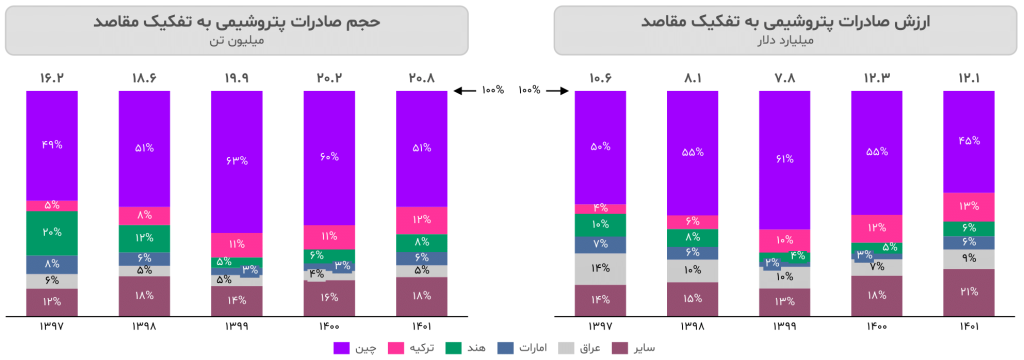

According to the laws, the country’s petrochemical companies are forced to prioritize domestic needs over exports. In 1401, China was the main destination for petrochemical exports, while a comparison of its share in volume (51%) and value (45%) of exports indicates the relatively low price of products exported to this country.

While the volume of Iranian petrochemical exports has experienced continuous growth between 2018 and 2022, the value of exports has undergone a turbulent trend, a phenomenon that could be due to the granting of discounts on exported products to maintain market share in order to counter sanctions.

In 1401, five countries collectively accounted for about 80% of the value of petrochemical exports and about 83% of the volume of petrochemical exports.

Despite China’s dominant share of the volume and value of Iranian petrochemical exports, which remained almost constant between 2018 and 2022, growing destinations such as Türkiye have been added to the export destinations of Iranian petrochemical products.

Turkey’s share of export volume more than doubled between 2018 and 2022, while in terms of absolute value, export volume in 2018 more than tripled compared to 2018.

Although exports to India have been increasing since 1400, the country’s share of the volume and value of Iran’s petrochemical exports has been declining, mainly due to a decline in exports after the imposition of sanctions in 2018.

The share of other countries in the volume and value of exports increased between 2018 and 2022, which indicates that new customers have been found for Iran’s petrochemical products; for example, South Africa hosted a significant volume (0.5 million tons) of petrochemical exports in 2022.

Top petrochemical players

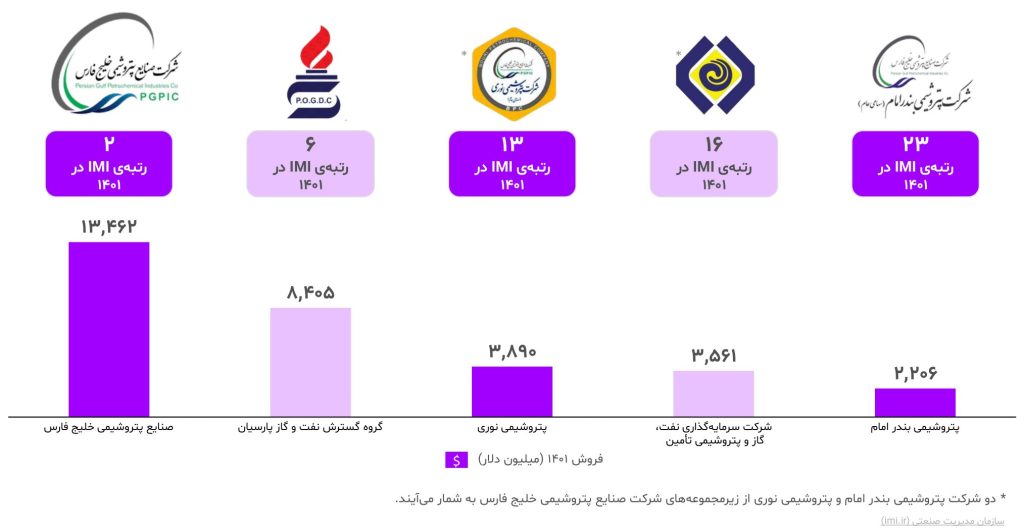

The Industrial Management Institute (IMI) began ranking Iran’s top companies in 1998, and its latest edition was published in January 2023, covering the performance of 2021.

The main purpose of compiling the IMI1500 ranking is to determine and rank the level of participation of companies in the national economy, in order to promote transparency and competition in the business environment and generally improve the position of Iranian enterprises. This comparison and ranking is based on financial information published in the companies’ financial statements.

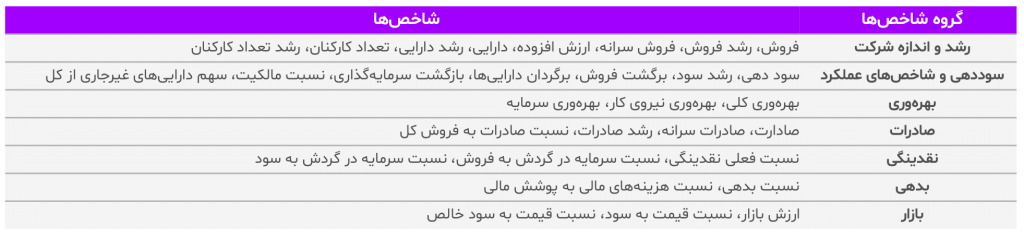

The economic effectiveness of a company’s activities at the national level is directly related to its sales volume. The Institute of Industrial Management ranks companies by considering seven main indicator categories, each of which includes specific and precise indicators:

According to IMI-500 (version 1401), the top five companies in the petrochemical industry among the top 500 companies are Persian Gulf, Parsian, Nouri, Tamin, and Bandar Imam, of which Nouri and Bandar Imam are subsidiaries of the Persian Gulf Group.